The best analogy I can think of explaining this major concern is if I was driving at 5th gear and change gears to 4th, does it mean I’m slowing down or am I gaining greater control over the car?

Chinese growth all these years has been fuelled by exports. It has seen double digit growth figures for many years now (1980’s onwards). It has transformed the rural architecture into modern bustling cities. China with its centralized, socialist economy has been able to drive growth and development much faster than any of the industrialized nations during their period of transformation. China today is world’s 2nd largest economy in less than 40 odd years, from being an ideal basket case.

What does it mean?

- Economic Growth in China has seen fluctuations in GDP growth at regular intervals.

- The Chinese economy tends to contract and then suddenly see rapid growth. It might have something to do with Military strategies of strategic withdrawal and Thrust forward after re-grouping.

- The Chinese economy tends to adapt to changing global economy.

What is China possibly thinking at this point of time?

- The Chinese Middle Class income group, those earning above 12,500$ p.a. is expected to constitute 40% of the total population by 2020. This percentage in absolute terms will exceed the combined population of EU, and be greater than the population of the United States.

- China’s urbanization rate was 47% in 2010 and is expected to be 55% by 2020.

- In 2005 a business enterprise needed to be in 66 cities to reach 80% of the middle class segment. By 2020, the same business enterprise needs to be present in 212 cities to engage 80% of the Middle Class population.

- Looking at these numbers, any Chinese policy maker will be thinking whether China needs to actually sustain growth by Exports? It can change its tactics and promote greater domestic consumption which would immunise itself from situations like GFC, Western interference and sanctions etc.

What does it mean?

- My take on China is, it is slowing down for a strategic purpose and that is to develop an economy which will be self-reliant and grow as a result of domestic demand and be less reliant on exports.

- There will be greater investments with in the economy, as more and more urbanization will occur. As a result, more and more people will rise above poverty levels and join the Middle Class segment.

- China will create its own Europe within its boundaries. It will lead to greater income generation, investments and employment. What it finally plans to achieve is SELF RELIANCE.

How would it affect Chinese economy?

- China will continue to remain a cost competitive manufacturing economy for years to come. It needs to ensure that people have sustainable employment and job security.

- It may not be very keen on making its currency RMB too strong but also too weak to attract American attention. Therefore it will look at developing alternative low cost export destinations in Africa, Middle East and parts of Asia where it has strong economic, diplomatic and military relations.

- It may take a much tougher stand on economic and bilateral relations with the United States and some European nations.

- China will still have a huge population which will be living below poverty lines and therefore this domestic growth, immune from external environment will provide time and resources to lift these under privileged to middle class income groups. In essence, Chinese growth will be there for all to see for next 70-100 years. It is for this reason, it is called the Asian century.

China and China dependent countries:

- China will re-orient itself to give more business to nations which it sees as allies.

- It will create its own Resource and Mineral Supply Chain in Africa, Mongolia and CIS by having politically neutral, investments which will be based on policies of Non-Interference and Political and Economic support in International forums.

- It is most likely to position itself as a ‘POOR MAN’S’ Banker and would develop many of the economies on fringe as its customers. A Low cost economy serving low cost economies- makes perfect sense!

TOP 10 trading partners of China

Trading partners in 2007

Trading partners in 2010

China’s Imports:

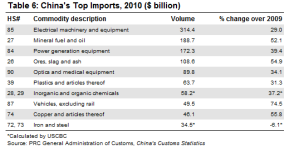

In 2010, China’s total imports were 922 Billion U.S. Dollars, down from 1.13 Trillion U.S. Dollars in 2008. The main imports included Electrical components & Machinery, Oil and Mineral fuels, Optical and Medical equipment’s, Metal Ores, Plastics and Organic chemicals. In 2010, the TOP 5 import partners included Japan (13.3%), South Korea (9.9%), USA (7.2%), and Germany (4.9%).

China’s Portfolio of TOP IMPORTS, 2010 (U.S. $ Billion)

Portfolio of Top Imports in 2007

Pattern of Portfolio of Imports in China- 1980- 2007

China’s TOP IMPORT SUPPLIERS

What does the above Table Reflect?

- Iron and Steel demand are on a decline. 2010 change over 2009 figures is -6.1%).

- There has been a massive increase in demand for Vehicles (excluding Rail) and the change over 2009 has been 74.5%. The other massive increases in demand have occurred for Ores, Slag and Ash +54.9%, Mineral fuel and Oil + 52.1%, Copper and articles thereof +55.8%.

- What it means is Chinese economy will still have huge import demands, however, the portfolio of demand will change. It may be more focused towards Heavy Engineering Electrical Machinery and Equipment, Power Generation equipment, Vehicles (Aircrafts, Heavy duty trucks, Cars etc.)

- What the above stats also reflect is slowdown in construction industry indicated by decline of 6.1% in demand for Iron and Steel.

- Countries like Mongolia have replaced countries like Australia as the largest exporters of Coking Coal. China’s imports from Australia in 2011 were 21% of its total Coking Coal imports, down from 37% in the previous year. Mongolia on the other hand increased its exports to China to 43% up from 32% a year ago. The resource market vacuum in China will increasingly be filled by nations in Africa, Mongolia and Asia.

Conclusion:

- China will continue to grow at rates above 8% for this financial year.

- China’s demand for certain portfolio of resources will decrease, and it will be indicative of sector wise slow down (for e.g. slowdown in Construction industry). It however, does not mean that whole of the economy will flatten.

- China will increasingly engage with nations which respect Chinese Civil and Military institutions, People and Culture.

————–

- [1] http://www.mckinseyquarterly.com/The_value_of_Chinas_emerging_middle_class_1798

- [1] http://shanghaiist.com/2012/02/10/report_chinese_middle_class_to_reac.php

- [1] http://shanghaiist.com/2012/02/10/report_chinese_middle_class_to_reac.php

- [1] http://shanghaiist.com/2012/02/10/report_chinese_middle_class_to_reac.php

- [1] http://www.starmass.com/china_review/imports_exports/china_top_trade_partners.htm

- [1] http://english.mofcom.gov.cn/aarticle/statistic/ie/200901/20090105999698.html

- [1] http://www.economywatch.com/world_economy/china/export-import.html

- [1] https://www.uschina.org/statistics/tradetable.html

- [1] http://www.starmass.com/china_review/imports_exports/imports_by_commodities.htm

- [1] http://www.starmass.com/china_review/imports_exports/imports_by_commodities.htm

- [1] https://www.uschina.org/statistics/tradetable.html

- [1] http://seekingalpha.com/instablog/134986-john-polomny/231698-mongolia-replaces-australia-as-largest-met-coal-exporter-to-china